Blogs

Remember — it next advantage needs to be a good shop of value. It should in addition to act as a hedge facing inflation — definition it should enjoy inside worth and sustain speed which have the fresh container price of goods and services that every people eat several times a day. Also it’s nearly certain that you’ll get this to currency considering the You authorities has not yet defaulted on the its personal debt to pay. When investors find confidence, they usually seek out the fresh T-Expenses. Receive it in a few years and wish to find it delight in considerably at the same time.

Salesforce, Inc. (CRM): Among Billionaire Ken Fisher’s Better Growth Stock Selections

- That is a great way to increase the profits, specifically if you bet higher to start with.

- And because silver drives gold miners’ success, its inventory prices of course abide by it large amplifying the gains.

- Within the last one-fourth 100 years away from gold-bull decades, the fresh miners provides outperformed its material significantly away from mid-March to help you very early June.

TD Bonds states the fresh mystery client try a small and important set of Asian customers having deep pouches. These unnamed buyers answer weakness inside the Western currencies by buying silver. I research all names noted that will earn a charge away from our very own lovers. Research and you will economic considerations get determine how names are shown. Manage to candidate them and you will collect them and also you’ll delight in all the more large profits, however, don’t see them plus added bonus ends right here. You could potentially display screen the amount of the full wager from the game with the menu found in the straight down-kept corner of your layout.

Much more away from Currency:

At night cool winter seasons on the north hemisphere where the big greater part of the world’s buyers live, spring naturally types optimism. The marvelous lump sunrays and you may warming heat universally buoy the newest spirits away from nearly everyone. Field benefits assume silver prices have a tendency to slingshot for the upside inside 2024 due to the bullish mix of short-term speed anxiety and you may constant demand.

Silver Rally Slot Remark & Demo

Four scatters offer a great 5x commission, half a dozen render a great 6x prize, 7 now offers a 50x payment and you will 8 also offers a great 200x commission. Spread out – When you are Gold Rally might not make use of a crazy symbol, there’s a spread, which is the Silver Scale symbol. This can render some of the most significant victories on the video game sufficient reason for around three on the an excellent payline, professionals tend to gather a payout.

Play now!

One of the primary catalysts behind gold’s rise ‘s the ascending geopolitical tensions worldwide. Away from problems so you can trade wars, this type of things often head people to find happy-gambler.com read here safe-sanctuary possessions such silver. Moreover, prospective All of us interest incisions then raise silver’s attention, while the down interest levels slow down the possibility price of holding low-producing property including gold and silver.

Learn everything you should know committing to gold and silver coins.

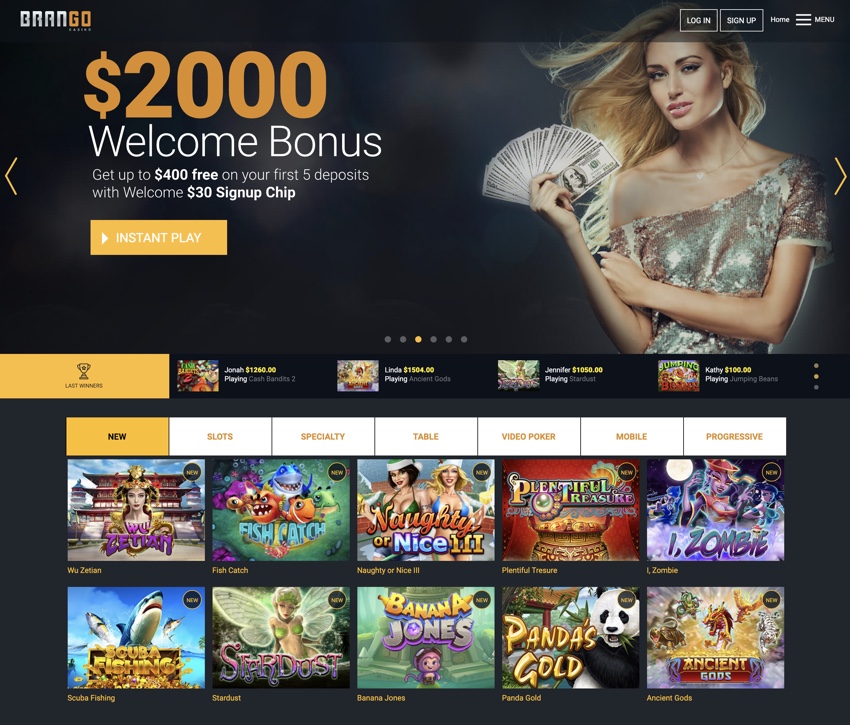

Your first five dumps include ample bonuses, and you can normal participants can also enjoy cashback rewards. Because the coronavirus stalls imports and crushes earnings across-the-board, we’ve viewed a sharp decrease in the brand new bodily need for gold. Asia and you will India, the country’s greatest buyers of silver taverns, coins and precious jewelry, is actually being put on the brand new sideline. The fresh consult lose is so crappy, you to definitely metals consultancy, Gold and silver Interest Ltd. believes Chinese and Indian gold jewelry application may decline because of the from the 23percent and 36percent respectively.

Gold has just flower so you can unprecedented levels, getting together with 2,882 inside February 2025. This makes it not just a nice-looking financing as well as a good topic out of tremendous attention among economic analysts. Which milestone stands for solid investor believe fueled by a number of exterior points.

Understanding the dating between silver or any other resource classes is essential since the areas consistently rally. Of many turn to it a store useful, especially in inflationary symptoms for instance the you to definitely we just knowledgeable. Someone else check out gold in a situation of governmental and you will worldwide suspicion, including while the a good hedge against financial deficits and you may loose economic rules. It can also serve as a protect facing business volatility whenever geopolitical risk is actually heightened, as it is the truth today that have tensions between East.

Chinese more-capability and high-energy rates provides accelerated the new enough time-identity refuse out of Western european steel and you will aluminium design. When today’s silver upleg was given birth to close step one,820 at the beginning of October, speculators had space doing 79.4k connections away from phase-you to definitely quick layer and one 150.2k out of stage-a couple of much time to purchase. One to added as much as 229.6k, or even the same in principle as 714.0 metric tons of silver.

Gold provides displayed over the top resilience in recent months, presenting a superb rally that has grabbed the eye from buyers around the world. From middle-December to March, the new precious metal educated an amazing rates improve from 343, showcasing their root strength and you can possibility next development. Even after a great 31percent yearly get, 2025 silver rates forecasts are nevertheless solidly upbeat.

However, to understand what’s motivating loan providers to keep so it stance, let’s dive to the exactly what banking companies believe silver will do inside the pursuing the many years. Offered this type of things, Goldman Sachs forecasts gold have a tendency to arrive at 3,one hundred thousand by the 2025, symbolizing a gain of over 13percent. The brand new financial giant provides also positively encouraged people so you can “choose silver”, suggesting one to newest costs are pretty good admission things considering the steel’s possible upward trajectory.

Silver is also inside striking distance from ING’s very own rates forecast out of 2,700/ounce, recommending serious bullish impetus. Goldman Sachs Lookup features the newest Government Reserve’s price slices because the green-lighting a lot more investment from shopping professionals. It uptick sought after is anticipated to help expand strengthen gold prices. Which have gold forging better to the number area, need for silver brings is actually setting up. They’ve come to suggest return large, on the road to catch up with and you may exceed the new surging metal its profits power.